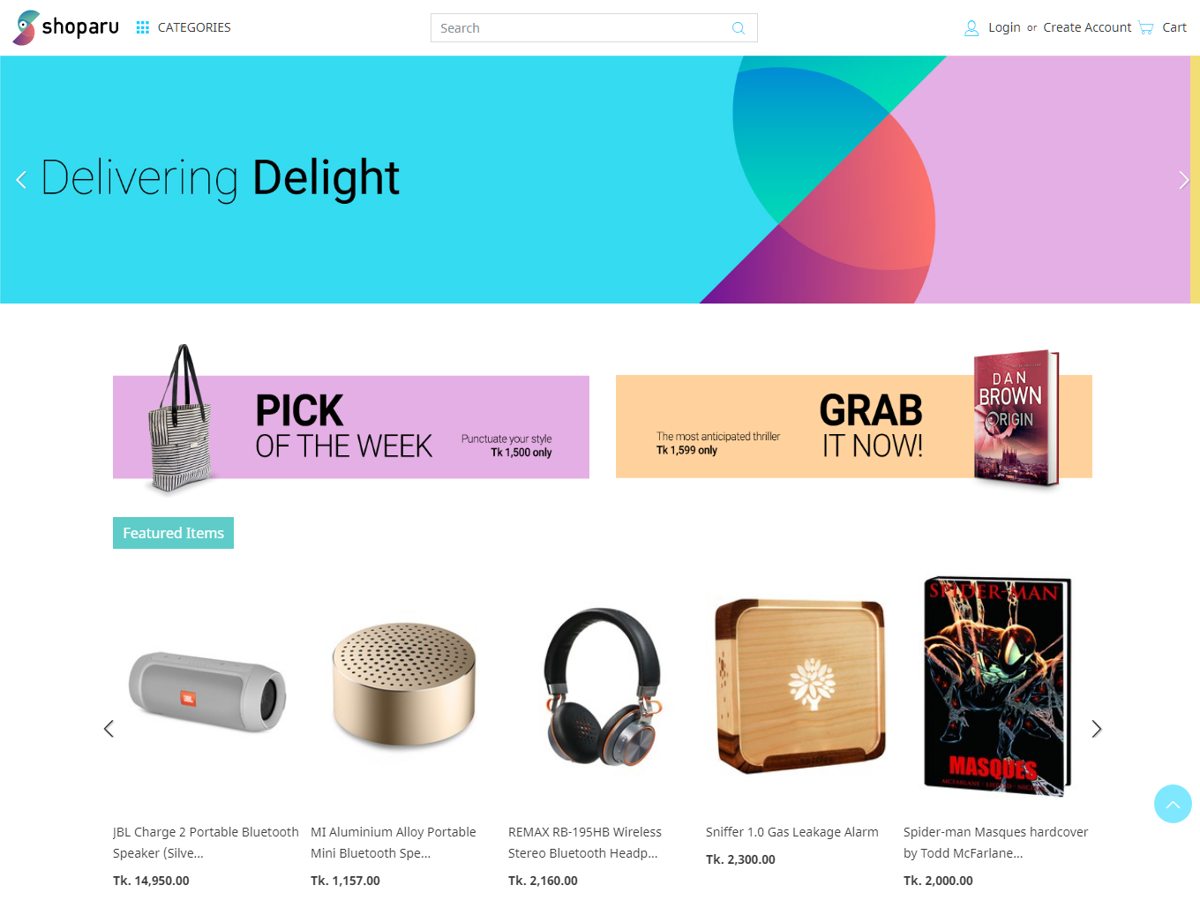

Grameenphone is preparing to launch a new eCommerce marketplace called Shoparu.com, people familiar with the matter said. The leading telecom operator has been working on the platform for a while now and a beta version of the platform is already out.

“Shoparu is an online marketplace from Bangladesh aspiring to offer delight on each transaction. As a marketplace shoparu integrates suppliers across Bangladesh & connects them seamlessly to online consumers all over the country.

It is an Operator Agnostic Digital initiative from Grameenphone who is the first telecom operator to become a member of eCAB (eCommerce Association of Bangladesh). Shoparu aspires to take an enabling role in solving real problems within the eCommerce ecosystem while creating value to all the members and customers alike.”

The effort will be closely watched for several reasons:

“As we do not have much control over quality with such partner-dependent platforms as Ki Dorkar, the promotion and operations of the platform have therefore been discontinued,”.

It is important to note that Kidorkar.com never gained much traction, particularly from end-users. It had, though, a good merchants base.

It is safe to assume that GP has learned its lessons from previous misfires.

The operator maintains a close tie with eCab, the association of ecommerce companies in the country, and this time it certainly doesn’t want to face the backlash it faced with GP Shop. The company is expected to try eCommerce as an independent venture which apparently, at least, clears it from any legal challenges.

Having said that, the question regarding net neutrality will certainly be raised, and I think it is a logical one although there may be ways to deal with it.

It is important to note here that GP’s ecommerce strategy is quite distinct from rest of the telecom operators except for Robi which has an investment in a ticketing platform.

From our previous report on this topic. A relatively longer excerpt than usual, please bear with me:

"GP takes interest in Bangladesh’s digital ecosystem and rightly so. A strong digital ecosystem and available local content can help the company grow its data business significantly. It has already a couple of quite active services in the space.

GP’s music streaming service, GP music, most active of two such services, has been doing quite well and now attracts around 80k users monthly, according to similarweb data. The company has a content app called Wowbox, offering a host of services including packages, news updates, jokes, lifestyle tips, games and more.

GP has a mobile ticketing service called MobiCash. It has also got into an agreement with DBBL and now marketing an MFS service called GP wallet. GP’s kidorkar.com, an ecommerce aggregator platform is also testing a myriad of services. Here is a list of prominent digital services by GP and its parent company Telenor."

On to eCommerce commentary:

“GP Shop launches with hefty plans. During the launch, the company talked a lot about the problems of existing ecommerce shops and also pointed out how it could address those shortcomings. It plans to be the most powerful ecommerce platform in the country over the years, although the question whether a telecom operator can run a stand-alone ecommerce venture remains.”

The company will certainly offer same assumptions behind launching Shoparu and it makes sense because unless there is no problem in the existing market then why do we need another eCommerce.

The question then, however, why GP failed to execute with Kidorkar and address these challenges. A good question to ask, more so for GP eCommerce team.

I suspect that many of the challenges that our eCommerce companies are facing today are not purely execution challenges rather infrastructure challenges. In fact, GP’s logic behind shutting down kidorkar.com supports this assumption. Now when GP again claims it is going to fix the challenges, it simply does not sound credible anymore.

Again from our earlier report:

“GP boasts a wide distribution channel across the country that, according to the project insiders, will help GP Shop with distribution and delivery. It also claims to make payment easy for its users by using its existing infrastructure.

A strong brand awareness helps it with trust issues that many regular ecommerce platforms face. Above all, it has a deep pocket to stay in the game for a longer period of time and a huge user base to whom it can reach out just via SMS at no cost.”

Although the latter advantage brings up the question of net neutrality and allows other players to question GP’s legitimacy to operate in the commerce space which means many of GP’s advantages are also its weaknesses.

“Many of the existing ecommerce players don’t enjoy any of these advantages which gives GP an edge over competitors. But having certain advantages over your competitors does not make you stronger by default, how you leverage those advantages makes all the difference.”

All of the above points still hold, albeit with a minor change. Given its previous misfires, as I noted earlier, GP’s brand is unlikely to help it in eCommerce because there is already a quite strong perception that GP is no good in eCommerce. This will certainly hurt its effort to attract business partners that is merchants and users.

“Positioning would be a tough call for the same reason it has advantages over other brands. eCommerce is a long game and it will take significant time to make it work in Bangladesh.

If we look at the examples of other corporate initiatives, there is a very good chance that GP would lose interest in GP Shop and would not apply continuous effort for that long. And there are regulatory issues that many industry insiders are raising and we don’t know the outcome yet.

Moreover, startups are an entirely different thing. Startups do not work like a big company. For big companies, most hired people build a product, team change is a regular process and when that happens it changes everything about a product. This is more so for highly successful companies. Nothing fails like success.

The most important disadvantage is bureaucracy. In a big company, every decision is made through a process, whereas startup is all about speed.”

My analysis about kidorkar.com and ekhanei has been proved right. The dynamics of digital businesses is different and it will be a tough call for GP to make it work. Moreover, it has already lost some time in between initiatives which makes it a late entrant to the party. And when you are late, you are later. As I said, the challenges around credibility due to its past blunders in the space and regulatory challenges remain there.

There are certain advantages you enjoy being part of the number one telecom brand of the country. At the same, you own certain disadvantages for that same reason. It is impossible to enjoy the benefits without suffering the consequences. Shoparu will have to make a choice here.

Having said that, I’m excited as usual to see how this play out in the market in the coming days.

Cover photo: Shoparu website screenshort, retrived on Dec 5th, 2017